Can I get my backup withholding money back?įunds sent to the IRS for backup withholding cannot be returned to you, but you can report the backup withholding on your tax return. Without your tax ID, we’re required to send 24% of each payment you receive for goods & services to the IRS as backup withholding to cover any potential income tax due.ħ. If you do nothing, we’ll still be required to send you and the IRS a Form 1099-K.īackup withholding is when a portion of your payments is sent to the IRS to ensure that any tax due on those payments is paid. If you reach the $600 reporting threshold and haven’t provided your tax info, you’ll continue to experience tax holds and 24% backup withholding on the payments you collect for goods and services throughout the year. You may also wish to seek the advice of a licensed tax advisor.

PAYPAL FRIENDS AND FAMILY LIMIT DOWNLOAD

If you don’t end up selling $600, you can download your Venmo account statements to help you with any other reporting obligations you may have. This step also enables us to provide accurate information on your tax forms.

By providing your tax info, you can avoid experiencing payment holds and subsequent backup withholding. If you sell at least $600 in goods or services on Venmo during the calendar year, we’ll issue you a Form 1099-K at the beginning of the following tax season and send a copy to the IRS. What happens after I provide my tax info? This helps create a safer marketplace by making both the buyer and the seller eligible for Purchase Protection if something goes wrong on either side.Ĥ. All payments sent to business profiles on Venmo are tagged as purchases automatically and are therefore considered to be for goods and services. Whether it’s for a product you sell, a service you provide, or even an old couch you don’t want anymore, the person paying for the item or service can decide whether to tag the payment. When sending money on Venmo, users can choose to tag a payment as being for “goods and services”. Some states have lower reporting thresholds.ģ. Instead, the IRS will use the same higher threshold from years past (total payments exceeding $20,000 and more than 200 transactions) for 2022. The IRS initially planned to lower the reporting threshold to $600 for the 2022 calendar year but has delayed that implementation by one year, to 2023. The IRS has always required payment settlement entities (PSE) like Venmo to report information and issue Form 1099-Ks. Remember: You can provide your tax ID in the Venmo app to avoid backup withholding on your payments.Ģ. Venmo will begin sending backup withholding to the IRS as soon as June of 2023.This is required by the IRS and helps to ensure that any applicable taxes due on these payments are paid. Venmo) is required to withhold 24% of those payments and send it to the IRS for backup withholding. If you collect $600 or more for the sales of goods and services through a payment services company without first providing your tax info, that payment services company (i.e. This information is not intended to be and should not be construed as tax advice.įor the tax year 2023, the IRS will use a lower threshold of at least $600. To determine whether specific amounts on your 1099-K are classified as taxable income, you should speak with a tax professional.While Venmo is required to send this form to qualifying users, it’s worth noting that certain amounts included on the form (like refunds) may not be subject to income tax. Some states have lower reporting thresholds:Īnyone who met the $20,000 and 200 transactions reporting threshold (or the $600 threshold in applicable states) for payments received for goods and services through Venmo, or any other payment app, can expect to receive a Form 1099-K.

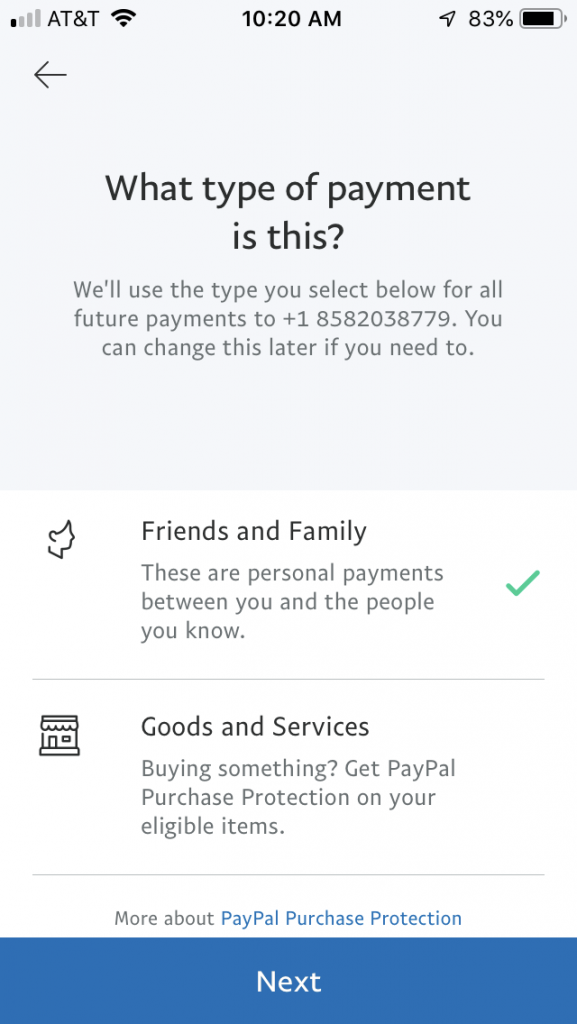

This requirement only pertains to payments received for sales of goods and services and DOES NOT apply to friends and family payments.įor the tax year 2022, the IRS will require reporting of payment transactions for goods and services sold that exceed $20,000 and 200 transactions.

Some states have lower reporting thresholds. For the tax year 2022, the IRS will continue to use the reporting threshold of total payments exceeding $20,000 for goods and services and more than 200 transactions. Note: The IRS has delayed the implementation of the $600 reporting threshold for payment transactions for goods and services by one year.

0 kommentar(er)

0 kommentar(er)